- Earlier this week, Needham analysts reiterated their outlook on Boston Scientific Corporation following the company’s initiation of patient enrollment for its clinical study evaluating the Bolt laser-based intravascular lithotripsy (IVL) system for peripheral use, planned for launch in late 2025.

- This move positions Boston Scientific to capture a substantial portion of the US$8.5 billion IVL market by leveraging synergies within its Peripheral Interventions and Interventional Cardiology portfolios.

- We’ll explore how the anticipated clinical advantages of the Bolt IVL system could influence Boston Scientific’s long-term growth narrative.

Find companies with promising cash flow potential yet trading below their fair worth.

Boston Scientific Investment Narrative Recap

To be a shareholder in Boston Scientific, you ultimately have to believe in the company’s ability to drive sustainable innovation in minimally invasive medical devices while expanding its market presence globally. The announcement of the Bolt IVL system trial broadens product differentiation, but near-term earnings are still likely most sensitive to regulatory and pricing risks, as well as evolving cost pressures, making the immediate impact of this news more strategic than financial.

Among the recent announcements, the expansion of the FARAPULSE Pulsed Field Ablation System’s FDA label stands out. This is especially relevant as it reinforces Boston Scientific’s push for clinical leadership, which dovetails with the anticipated entrance of the Bolt IVL system and underpins future growth potential around procedure adoption and revenue streams.

In contrast, ongoing cost headwinds from tariffs and recent product discontinuations remain significant issues every investor should be aware of…

Read the full narrative on Boston Scientific (it’s free!)

Boston Scientific’s outlook calls for $25.4 billion in revenue and $4.8 billion in earnings by 2028. This is based on analysts forecasting 11.1% annual revenue growth and a $2.3 billion increase in earnings from the current $2.5 billion.

Uncover how Boston Scientific’s forecasts yield a $124.53 fair worth, a 27% upside to its current rate.

Exploring Other Perspectives

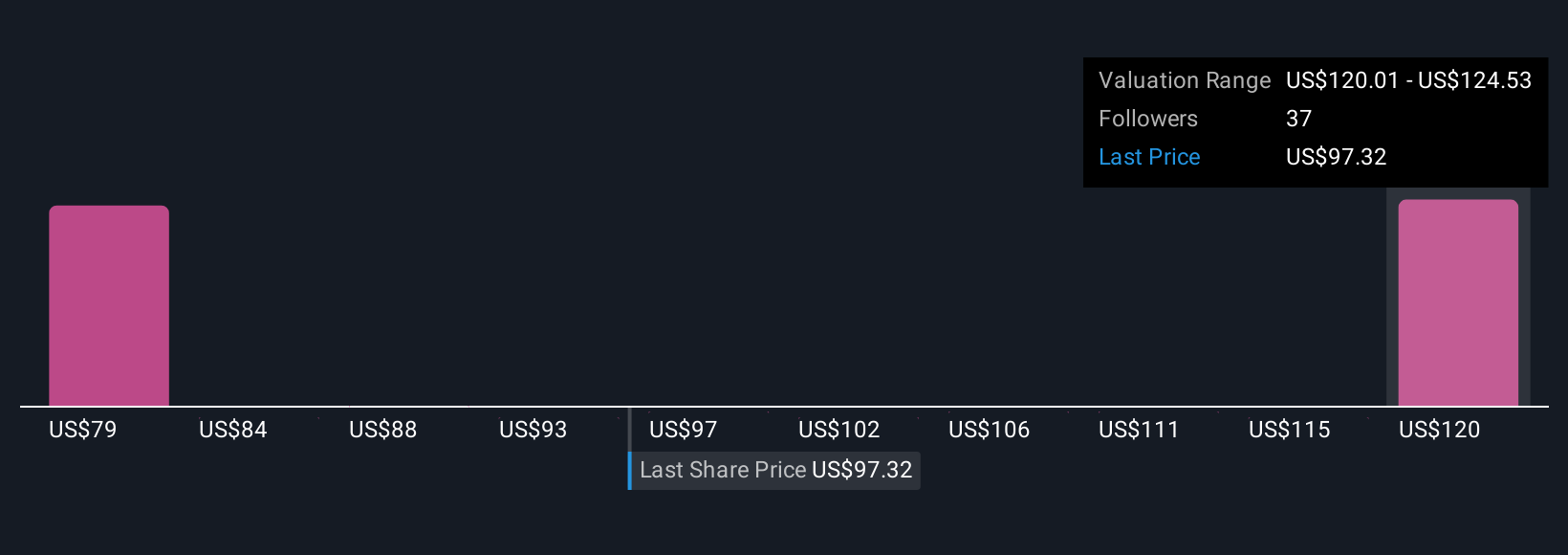

Simply Wall St Community members put fair worth estimates for Boston Scientific between US$79 and US$124 per share, reflecting a 7-way split in outlook. Regulatory and payer risks highlighted in recent analyst commentary could weigh on results as you consider the range of potential futures for the stock.

Explore 7 other fair worth estimates on Boston Scientific – why the stock might be worth 19% less than the current rate!

Build Your Own Boston Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready To Venture Into Other Investment Styles?

Opportunities like this don’t last. These are today’s most promising picks. Check them out immediately:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to grab or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the up-to-date rate-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair worth estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com